Tax credits, rebates and bonus rebates can make home improvements more affordable.

You can bundle our equipment rebates with tax credits to maximize your savings.

Complete multiple qualifying projects to earn up to $350 in bonuses in addition to our standard rebates. Major ENERGY STAR® certified equipment, insulation, and air sealing upgrades can each qualify towards bonuses. Learn how you can maximize your rebates with bonuses.

Learn About Bonuses

3 GREAT WAYS TO SAVE

Don’t miss out. Combine these opportunities to save extra on home energy improvements.

Federal Tax Credits

You may qualify for a federal credit of up to $3,200 for efficient equipment or home improvements made to your primary residence.

Projects that may qualify for a federal tax credit and our rebate program include:

- Air Sealing

- Air Source Heat Pumps

- Central Air Conditioning

- Mini-Split Heat Pumps

- Heat Pump Water Heaters

- Insulation

Note that each of these six upgrades may also qualify toward our bonus rebates.

Learn more about tax credits for heat pumps, heat pump water heaters, air sealing and insulation. Or, explore all energy efficiency federal tax credits.

Whole-Home Solutions

Considering multiple home upgrades? Learn about our Deep Energy Retrofit Bonus. A trained and licensed contractor can help you optimize your savings and create a personalized project plan.

Find Rebates and Get Started

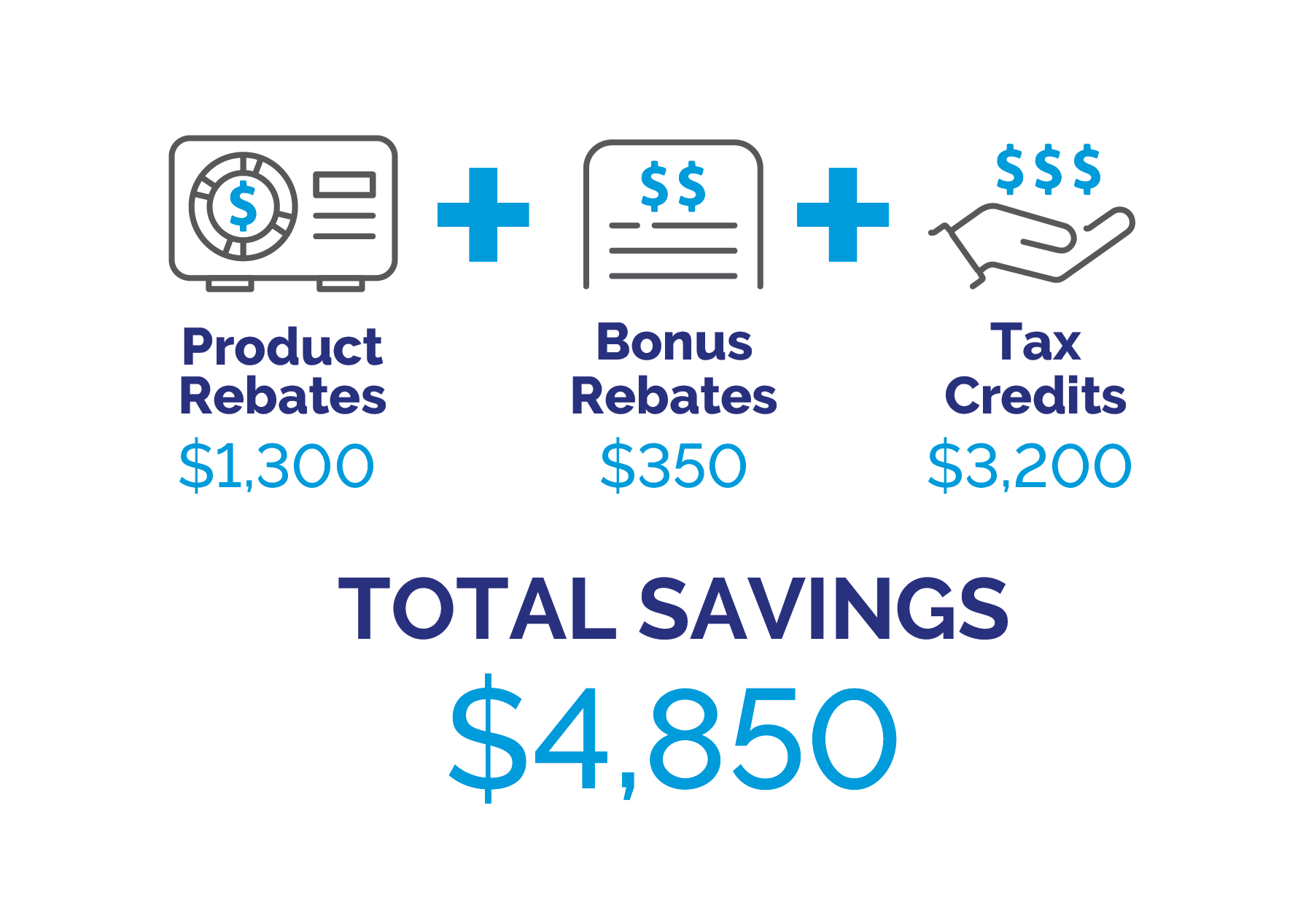

BUNDLE YOUR SAVINGS

Example Project Scenario: Install new insulation, ductless heat pump and heat pump water heater.

Check out our full list of energy efficiency rebates.

Find Rebates

The content on this site is for informational purposes only and is not tax advice. All content mentioned does not constitute professional advice and is not guaranteed to be accurate, complete, reliable, current or error-free. By using this site, you accept and agree that following any information or recommendations provided therein and all channels of digital content is at your own risk. Please consult a tax professional before claiming and filing.